Shopper Habits Shift Due to Coronavirus, EIQ Survey Finds

The barriers to online shopping have been reduced, with a number of shoppers doing more online ordering of food across different delivery formats, due to the coronavirus (COVID-19), a survey conducted this week by Path to Purchase Institute reports.

The Institute’s survey identifies a more thoughtful, deliberate shopper, as well as behavioral changes which include a significant number of shoppers moving toward online ordering and out-of-store pickup options.

Fielded March 13-15, EnsembleIQ conducted an online survey among 1,001 primary household grocery shoppers in the U.S. to evaluate the impact of COVID-19 on shopping behaviors.

Uptick in Online Ordering of Food

Among the more commonly expected outcomes of the pandemic is a surge in grocery e-commerce, with many industry analysts predicting a true tipping point in relation to brick-and-mortar shopping as consumers discover the relative ease (not to mention physical safety) of online shopping options, the Institute notes.

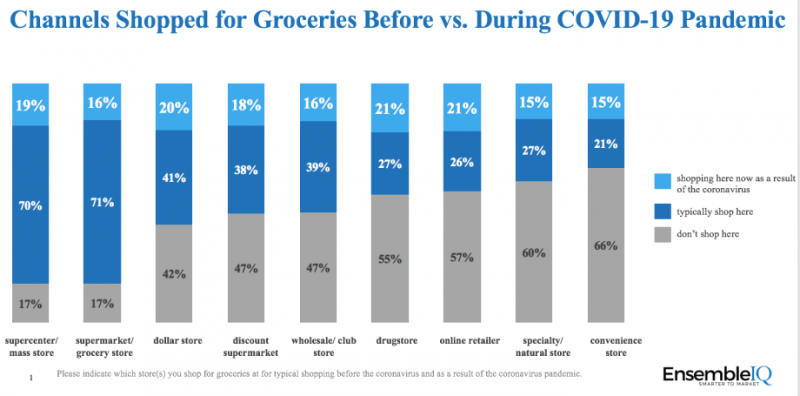

EIQ’s survey found 18% of shoppers said they are more often buying food online for home delivery and buying online for curbside pickup. The survey also uncovered an increase in online-conducive pre-shopping behaviors such as meal planning (28% more likely), price comparing (22%) and reading product reviews (18%). Additionally, 21% reported they are now shopping online retailers as a result of the coronavirus, while 26% reported they don’t typically shop online retailers.

Adoption levels for online buying were roughly the same for personal care and household supplies, as well as for OTC and prescription medications, the Institute reports. One possible check on more widespread adoption might be the fact that only 16% of shoppers say they have a high level of trust in the ability of retailers or delivery personnel to be sanitary and safely handle orders during preparation and delivery. Retailers themselves might very well help fuel greater adoption of home delivery, since a number of chains in recent weeks have dropped the service charges often associated with low-purchase online orders. The level of “shelter in place” guidelines set by municipalities, as well as the length of the COVID-19 outbreak, could ultimately have a major impact as well.

Store Loyalty Adjusts

In light of the pandemic, 44% of shoppers surveyed are visiting stores other than their usual store. The top reason (58%) is for more product availability, not surprising considering the growing reports of stock outs. Twenty-three percent did so to avoid purchase limits, which retailers have been enacting to try to curb stock outs.

On the product side, 34% of respondents who’ve shopped at a different store since the crisis began said they did so in order to buy their preferred brands — suggesting that the “whatever is on the shelf” mentality that has seemingly driven recent purchase behavior might be slightly misleading, the Institute reports. Indeed, 22% of shoppers remain steadfast in their desire to “only buy my preferred brands.” While 58% expressed a readiness to buy another brand if their favorite isn’t available, only 21% said they’ll buy “any brand to get the items I need.”

When it comes to retailers, a more surprising find is that the No. 1 trusted retailer during this time is Walmart, leaping over Amazon in this respect. When asked which retailer they trust to provide the products and services they need during the crisis, 18% of shoppers named Walmart. Target and Amazon were each identified by 6%; Kroger and Costco were cited by 3%. In total, 67 different retailers were named.

Collectively, the Institute notes these results suggest that, despite the upheaval in behavior caused by the pandemic, retailers and brands still have an opportunity to retain loyalty if they’re able to stay ahead of changing consumer demand and meet the needs of shoppers confronting an uncertain future — obviously, a task that’s far easier said than done in these exceptionally difficult times.