Retailer Sources of Pricing Power

Moneyball is one of my all-time favorite books and movies. While the book is chock-full of data and wisdom, the movie storyline presents an old-school storyline of us versus them, new versus old. In sports, the goal is not necessarily to up your prices (at least not on the field) but to win a game.

What team owners seek is predictive power. They build complex models of how to assess talent, how to assemble a team, and how to win more games than everyone else. They are constantly on the lookout for data sets that yield additional predictive power.

Retail executives also want predictive power. Retailer scorecards are measured in sales and profit. Typically, huge amounts of data come in everyday reporting on sales, marketing, operations, etc. About ten years ago, I was at a large company’s headquarters and they had the walls of a 30-foot hallway covered with one-page charts showing various metrics. They were updated weekly. When I asked the (new) CEO who reads these, the answer was “as far as I can tell, no one does.”

More data doesn’t make you smarter. Better data does. And one of those is pricing power.

Pricing power is the ability to raise prices without negatively impacting the demand for that product or service. At a 2011 conference, Warren Buffett said, “The single most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price by 10%, then you’ve got a terrible business.”

The general view is that for a company to possess pricing power, they need to be unique. In today’s world, with competitors popping up almost daily, true uniqueness is very difficult to achieve for any extended period of time. So to obtain pricing power, companies must first use their predictive power. This requires a new way of looking at what customers want, and what they are willing to pay more for.

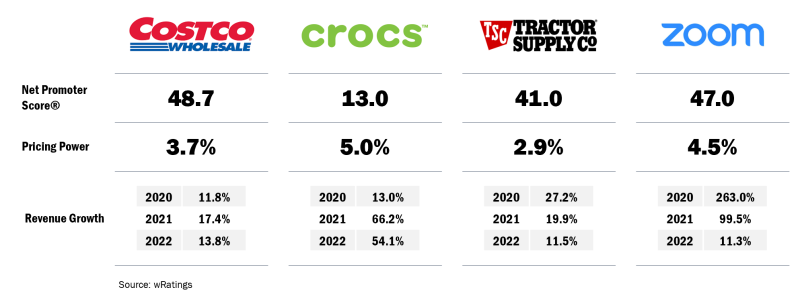

We just released our W Report that includes pricing power data on three retailers from the RIS News Top 100 Retailers: No. 4 Costco (COST), No. 34 Tractor Supply (TSCO), and No. 86 Crocs (CROX). We added Zoom (ZM) to our retailer focused report to illustrate how retailers can overlay customer data from another industry to generate new ideas to increase their pricing power. One of Zoom’s unique strategies is to deliver happiness to its customers.

Although all four companies compete in different markets and in different ways, they have posted double-digit revenue growth throughout the pandemic, and two with more volatility. Their Net Promoter Scores also vary along with their pricing power. However, one impressive similarity does exist: They think outside the box. Or more accurately, they all created a new box.

Alan Kay, best known for creating the window interface for computers while at Xerox PARC, is often credited with saying, “The best way to predict the future is to invent it.” These four companies have done that by creating new rules that rivals must now follow. These rules provide them with the uniqueness that drives more pricing power. The more powerful those rules, the more customers are willing to pay a premium when buying there.

The Costco “triggers and treasures” approach uses a series of rules that the company follows. For example, Costco wants to provide exclusive member services and a wide selection of merchandise, all offered with shopping convenience. Omnichannel retail is near essential today, so a Costco e-commerce site was a no brainer. But herein rests the dilemma: Costco respects exclusivity and offers a select assortment of SKUs, so it’s impossible to compete with Amazon, Walmart, and others on the same playing field.

Enter a new way of thinking about customers. When assessing which areas for Costco customers possess pricing power, innovation is the highest. After overlaying the Zoom customer profile on the Costco customer profile, a few key differences emerge. Zoom customers expect more innovation and curiosity, and they get it. Is it possible to raise the bar on Costco customer expectations for innovation while still remaining authentic to their “triggers and treasures” approach?

While still not very well-known, the Costco Next program does exactly that. The program provides members with access to extremely limited time-deals (days) direct from suppliers at Costco discount prices. The result for customers is more innovation, more curiosity, more treasures. And as more members use Costco Next, they should become as happy as Zoom customers in all these areas.

To see other pricing power opportunities for Costco, Crocs, Tractor Supply and Zoom, we’ve made The W Report free to download for a limited time.

Gary A. Williams is the founder and CEO of wRatings and a co-managing partner at G2 Equity Partners.