Resale, Rental and Subscription Models Revolutionize Retail

Pre-pandemic, the rental and resale retail markets were both heating up naturally as consumers grew more eco-conscious. Subscriptions and memberships were hot as e-commerce steadily climbed and retailers sought ways to build customer loyalty and forge digital-native brands.

Then the health crisis hit. While the rental market has felt the full swing of new challenges from COVID-19, a new wave of budget-conscious shoppers may be a boon for resale. Subscriptions and memberships are benefiting from both a burst in e-commerce activity and new demands for the physical one-stop-shop. Below, RIS examines the current and future states of resale, rental and subscription/membership models and how they are revolutionizing retail in 2020 and beyond.

Resale Retail

Second-hand merchandise appeals to three main types of shoppers, sometimes overlapping: those concerned about sustainability, budget-conscious and bargain shoppers, and those who enjoy the thrill of the hunt. The second-hand market is expected to reach $64 billion by 2024, according to thredUP’s “2020 Resale Report,” and the current health crisis doesn’t seem to be a drain on that number.

Half of people are cleaning out their closets more than they were pre-Covid, thredUP reports, and while continuing jobless claims fell to 13.3 million in September, a drop of more than 1.2 million from the previous week, millions of Americans are still unemployed, while many others are tightening their budgets amid uncertainty. Add that to the fact that just over half (51%) of U.S. consumers believe that sustainability is at least somewhat important, while the number jumps to 61% in the U.K., according to a CGS survey in May 2020.

Additionally, one of the biggest changing shoppers habits the pandemic has brought is the surge in e-commerce. Online shopping rose 55% year-over-year to $66.3 billion in July 2020, according to the Adobe Digital Economy Index. While the joy of discovery that brick-and-mortar shopping provides consumers may be tough to move online, second-hand shopping can bring that thrill to the digital space.

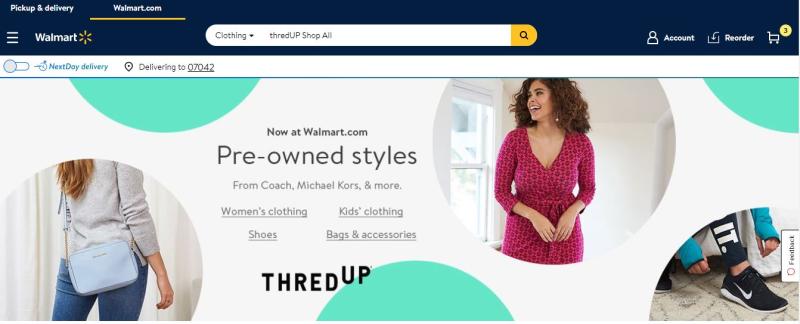

Retail behemoth Walmart realizes this. Through an online partnership with thredUP, Walmart entered the resale market in May with a dedicated website offering shoppers around 750,000 pre-owned women’s and children’s clothing, accessories, footwear and handbags.

“We know that customers, especially millennials, are interested in shopping resale clothing,” said Denise Incandela, head of fashion, Walmart U.S. eCommerce. “This partnership is our latest move to establish Walmart.com as a destination for fashion and offer customers the pre-owned items they might be looking for.”

Walmart isn’t the first national retailer to partner with thredUP in order to enter the resale market. Gap, JCPenney, J.Crew’s Madewell brand, and Macy’s have all forged similar partnerships.

Macy's has been selling used clothing at 40 locations in partnership with thredUP since August 2019, and reported in February that it found locating the merchandise adjacent to the juniors department has had the best outcome.

“It's definitely resonating with this millennial Gen Z customer,” CFO Paula Price noted at the time. “We have been able to attract many new customers that are coming into our brand.”

Other retailers to have entered the resale market include Selfridges, which recently launched Resellfridges, its first own brand resale model, for customers to shop pre-owned vintage or archive clothing and accessories in order to “help to close the loop on wasteful production and retail practices.” The department store also plans to launch a Repairs Concierge, helping customers to find which repair service is needed to make items as good as new. Similarly, IKEA plans to open a second-hand shop this year supplied with IKEA products that have been repaired and restored as part of its efforts to shift towards a circular business model.

Other retailers that have tested the resale market include Nordstrom, which launched See You Tomorrow powered by Yerdle earlier this year, offering shoppers a resale shop both online and in the NYC Flagship store (though it's since ended it). In 2019, Neiman Marcus acquired a minority stake in Fashionphile, a pre-owned e-commerce company focused exclusively on ultra-luxury handbags and accessories, before Neiman Marcus filed for bankruptcy.

Amid changing shopper habits, resale remains a bright spot in retail. Since April, luxury resale companies Fashionphile, Rebag, Vestiaire Collective and The Luxury Closet have attracted more than $134 million in total investments, Glossy reports. Fashionphile was the latest, having announced at the end of August it has raised $38.5 million in a funding round led by NewSpring.

"As the demand for sustainable fashion continues to balloon, we believe resale is driving the future of retail,” said Fashionphile founder and president Sarah Davis. “It's our goal to bring scale and state-of-the-art technology to second-hand shopping and ultimately draw more consumers into the circular economy.”

Rental Retail

While resale is finding its way, the retail rental market is shifting.

Fashion rental retailer Rent the Runway said in August it will shut all of its stores for good; it told CNBC it’s making the decision in order to focus its investments on digital and add more drop boxes for customers. Its brick-and-mortar stores in Chicago, Los Angeles, San Francisco and Washington, D.C. will be closed, while it will convert its New York City flagship into a permanent drop-off site for return clothing.

From office attire to ball gowns, Rent the Runway’s clothing rentals have been impacted from restrictions around COVID-19 reducing events consumers would need these clothes for. In March, the retailer laid off its entire retail staff via Zoom, according to the The Verge. At the time, all of its stores were closed due to the pandemic. During the Zoom meeting, a company executive reportedly said the business has been forced to “dramatically reassess” its current operations in order to sustain the business.

Rent the Runway was born online so it’s not a huge leap for the digital native to return to its online roots. Department store retailer Macy’s, on the other hand, dipped its toes into the digital subscription rental market last year with a new program at its Bloomingdale's chain called "My List at Bloomingdale's." Macy’s partnered with CaaStle on the program, which offers four pieces of clothing and unlimited exchanges for $99 a month.

Macy’s revealed earlier this year that it was finding 50% of the subscribers are millennial and 30% are brand new customers to Bloomingdale's. The retailer said new customers like the service because they “trust” Bloomingdale's and are “enjoying the quality of the service.”

While apparel rental is certainly in flux, the stay at home movement has caused shoppers to pour more money into their homes. Furniture retailer Fernish, which rents home goods from such brands as Crate & Barrel and Floyd to consumers on a monthly basis, has quickly learned that agility and responsiveness are the keys to succeeding in the current retail landscape.

Consumers who sign up for Fernish can rent such items as tables, bedframes, chairs and desks for a minimum of three months and a maximum of one year. Items are delivered, assembled and placed in homes.

“Customers’ needs are always changing, and it's important to be nimble so that you can adjust to what your customers want,” Barlow tells RIS. “As demand for home office essentials has increased, for example, we've quickly been able to increase SKUs and inventory counts for desks, chairs, lamps and shelving.”

“We’re finding our work from home items have been extra popular lately,” Barlow continues. “We're actually seeing customers who specifically want an office setup that's separate from their table, or in some cases their bed, because it helps them with comfort and posture.”

The rental retailer also made quick changes to its delivery services this year in order to ensure the safety of its associates and customers, including a default delivery option of a no-contact curbside drop-off. Associates will still assemble most furniture that fits through a doorway, and will then place them outside the customer's door.

Subscription/Membership Retail

Over the past few years, the rise of e-commerce and subscription box boom has led to consumers being able to subscribe to practically anything today.

Case in point, Hello Subscription’s 2020 Award Winners for “Best Unique Subscription Boxes” includes Henny & Roo, a subscription box for backyard chicken enthusiasts; The Inky Box, for calligraphy enthusiasts; ZenPop’s Ramen Pack, filled with eight kinds of instant noodles; and in light of the latest craze, the SavageCBD subscription box for CBD products. While these quirky boxes fill a niche, most consumers are familiar with meal kit retailers HelloFresh and Blue Apron, beauty retailers Birchbox and Ipsy, and grooming brands Harry’s and Dollar Shave Club.

“During the pandemic, it’s no surprise that we saw the demand for e-commerce among consumers rise, and retailers had to adapt quickly,” Tom Caporaso, CEO of Clarus Commerce, tells RIS. “Part of this was the rise in subscription services offered and the benefits being more personalized to the brand’s most loyal customers. During a time where the market is ripe for programs that challenge the status quo, it’s important that monthly rentals, recurring subscriptions and premium loyalty programs reward customers with instant gratification for repeat purchasing.”

Over 25% of retailers report that recurring revenue programs deliver the majority of their revenue, and on average, companies that offer programs report that 41% of their revenue can be attributed to these programs, according to a NAPCO Research and Ordergroove study released in early 2020. Additionally, 87% of retail leaders surveyed saw an increase in year-over-year revenue from recurring revenue programs, including 17% stating that the revenue contribution from these programs has “increased significantly” or more than 50%.

Later this year, a study from CouponFollow found that during the COVID-19 crisis, around 20% of US consumers purchased subscription boxes just to have those products available to them during the pandemic, with clothing boxes and meal kit boxes ranking highly. Of over 1,000 shoppers surveyed April 22-30, 2020, it found on average consumers had two active subscription boxes, spending a monthly total of around $58. Interestingly, more than a third of respondents said that they’re paying for boxes they don’t really use or need, and over two-thirds (79%) of subscription box consumers stated they will keep their boxes coming, despite any financial effects of the pandemic.

“The pandemic caused a heightened sense of fear around access to products and this led to an uptick in finding alternative ways to receive goods,” Marc Mezzacca founder of CouponFollow, tells RIS. “Many Americans turned to the subscription box industry as a way to bring a sense of comfort and convenience after the pandemic had created issues for in-store shopping and problems in the supply chain.”

Beyond the box, big name retailers are launching memberships to cultivate loyal customers both online and in-store. Amazon Prime members enjoy perks when shopping in Whole Foods Market stores and Walmart just rolled out its new competitive membership program Walmart+.

“As we’ve seen with Walmart+ ... this model is tailored to fulfill every aspect of a consumer’s daily life,” says Caporaso. “If you’re a part of the program, you can have your groceries delivered that same day, receive discounts on fuel and get home items delivered faster than Amazon. This is where subscription models and premium loyalty programs are headed — adhering to all consumer needs, providing fast, free shipping, value every time a member engages, and also getting more and more personalized over time. Established retailers are smart to consider subscriptions because it’s a way to connect with their most loyal customers, find out what they most value about the service and improve the model for the betterment of all consumers moving forward.”

Established retailers Sam’s Club and BJ’s Wholesale Club are two chains that have always run under a membership model, but the health crisis has been an accelerant for signing up new customers. BJ’s said during its Q2 2020 earnings call that it has acquired and retained approximately 18 months worth of members in just the past six months, an acquisition pace that would have it gain three years of membership growth in just one transformative year, if the pace continues.

In the apparel space, Lululemon is set to expand its membership model. The retailer is testing memberships in Chicago, IL, and Denver and Boulder, CO, and will also bring the program to Toronto, Canada. The membership program "continues to celebrate community connection and provides a range of offering such as special product, dedicated online sweat classes and inspiring guest speakers to extend the Lululemon experience," CEO Calvin McDonald said in September.

The retailer first tested the loyalty program in Edmonton, Canada, and charged members $128 a year for a choice of pants or a pair of shorts, monthly curated sweat classes, attendance at curated events, and free expedited shipping on e-commerce orders. The response to the test was very strong, exceeding Lululemon’s expectations, it has said.

As retailers continue to forge on during the COVID-19 crisis, testing new models for retail will separate the innovators from those that get left behind as shopper habits change and the new customer experience forms. However, thanks to e-commerce and digital technology, these lessons can be applied to both the largest retailers to the smallest startups. The key is to find lively ways to engage the customer where they are, even if that place is home.

b736.jpg)

bec6.jpg)