The Decision that Changed Target’s Trajectory and Its Annual $4B Plan for the Future

Target plans to invest approximately $4 billion annually for the next several years after record sales growth, but its 2020 triumph is not an overnight success story.

Target posted 2020 sales growth of more than $15 billion, an amount greater than its total sales growth over the prior 11 years. But the outcome stems from decisions it began making five years ago.

“We placed the physical store more firmly at the center of our omnichannel platform and we created a durable, sustainable, and scalable business model that puts Target on a road of our own,” CEO Brian Cornell noted in the retailer’s earnings call.

Fast forward to Target’s fourth quarter 2020 and more than 95% of sales were fulfilled by its stores and digital comparable sales grew 118%, accounting for two-thirds of the company's overall comp growth.

“Standing at this meeting three or four years ago, it would have been hard for any of us or any of you to imagine digital penetration of 18% without a dramatic deterioration in our P&L, yet today we announced record-high full-year adjusted EPS of $9.42,” Cornell noted.

Target's omnichannel strategies have been key to retaining customers, especially during 2020, a year in which stores were closed and shoppers turned to e-commerce during the COVID-19 pandemic.

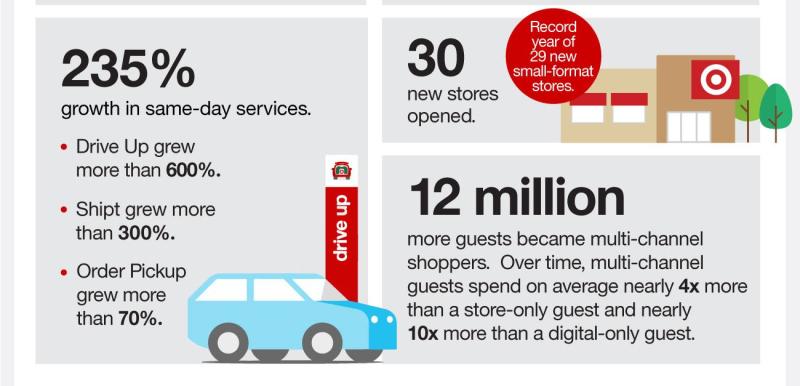

Its Drive Up curbside pickup service has proven a perfect example of this. Drive Up is part of the company's same-day services, which also include Order Pick Up and Shipt. Same-day services grew 212%, led by a 500% spike in Drive Up. This winning combo drove Target's digital sales to grow by nearly $10 billion in 2020.

"While other retailers struggled to be digitally relevant, Target already has the infrastructure in place to engage consumers the way they want to be engaged,” Gregory Ng, CEO, Brooks Bell tells RIS. “From the customer perspective, if they're going to order delivery, why not get it all in one place? If they want to minimize risk, why not go into the store that can check off all of their list in one place? As the new normal starts to unfold, Target is in great position to address those changing consumer demands digitally, in store, and everywhere in between."

“When we began this journey, we didn't know we would be facing a global pandemic, mass quarantines, rapid unemployment, and the need to limit the number of people in public spaces, and yet when those threats emerged in 2020, we were ready, and without hesitation, millions of American families turned to Target like never before,” said Cornell.

“Here's what I hope you'll take away from our story: first, that our team's ability to act and react in 2020 was years in the making,” he continued. “Without our multi-year road map to develop new capabilities and bring them to scale, 2020 could have exposed essential gaps in our business model. Instead, it proved beyond a doubt the durability of our model and it signaled our potential for continued growth in years ahead.”

Target Looks Ahead to the Tune of $4B

Target said its investments will go to accelerate new store openings and store remodels, enhance fulfillment services and strengthen its supply chain.

“As we head into 2021, we are building on the aspects of our differentiated model that make Target the preferred one-stop-shop for millions of guests,” said Target’s CFO Michael Fiddelke. “The bold investments planned for the next few years will scale key capabilities across stores, fulfillment, and supply chain to drive deeper engagement with new and loyal guests, continued market share gains, and long-term, profitable growth.”

Here’s a look at its plans:

Technology improvements will offer Drive Up customers a more personalized experience in the Target mobile app. This includes informing team members where to place the order in their vehicle or authorizing a different shopper, such as a family member, to pick up the order. “We're numbering our drive-up spaces so our teams can find guests sooner, for those times when a guest pulls up in a black SUV next to eight other black SUVs, and we're updating the team member app so they can more easily see what orders are in progress and where they can help,” said COO & EVP John Mulligan.

Target will increase the total fresh and frozen food pickup assortment after an “enthusiastic” response to last year’s addition of fresh, refrigerated and frozen food items to Drive Up and Order Pickup nationwide. Also, following a successful initial trial, adult beverage pickup will be offered in 800 more stores in the next few months.

Target will continue to bring brand partnerships to life in stores and online with the opening of approximately 100 Ulta Beauty at Target shop-in-shops in 2021, with plans to add hundreds more over time. Building on its more than 15-year relationship with Apple, Target has introduced a new Apple shopping destination online and in 17 stores, with an extended assortment, expanded footprint and service enhancements. More locations are scheduled to roll out this fall.

Following 30 store openings in 2020, including 29 new small-format stores, Target plans to open 30-40 new stores each year to meet community needs in urban centers, college campuses and dense suburban cities across the country.

Target plans to remodel more than 200 stores a year beginning in 2022. The future store design will focus on safety and ease, with additional contactless features, updates that facilitate same-day fulfillment and more room for social distancing. “Safety and ease have become the heart of Target's shopping experience and we'll incorporate what we learned during 2020 into our future store design,” said Mulligan. “That includes implementing more contactless features from our restrooms to our checkouts and adding distance between merchandise and at the check lanes.”

To add capacity to Target’s fulfillment operation and further scale its stores-as-hubs model, the company is testing a new type of facility in Minneapolis called a sortation center and expects to open five more in 2021. With this new last-mile capability, the sortation center collects online orders from local stores multiple times a day and sorts them into efficient routes for carrier delivery. This pulls the sorting activity out of store backrooms so it can be consolidated more efficiently at one facility, giving store teams more time and space to fulfill additional orders, while reducing the load on external carriers. “The idea is to make our stores-as-hub model even more efficient while also reducing our load on external carriers,” said Mulligan. “This capability frees up time and space in our stores which we can redirect into fulfilling more orders. In the end, it allows us to get orders to guests faster and at a lower cost.”

Target expects to open two distribution centers this year, one in Delaware and one in Chicago. Two more are planned in 2022 to support the east and west coastal areas.

This year, Target will continue expanding the rollout of its predictive inventory positioning capability across its assortment,” Mulligan said. “This helps us more precisely order and position product close to where we anticipate guests will want it, so we can react quickly when there is demand.”